FATCA – All You Need to Know About the Foreign Account Tax Compliance Act

Are you a United States citizen? Do you have business dealings or bank accounts outside the US? Then you need to know about this new federal law. Otherwise known as FATCA, the Foreign Account Tax Compliance Act is a law designed to increase US taxpayer compliance when it comes to overseas assets and investments. Read on to find out more about FATCA and how it affects you.

What is FATCA?

The Foreign Account Tax Compliance Act (FATCA) requires any United States citizen, including citizens that currently live outside of the US and US residents, to communicate to the IRS when they have money in financial accounts outside of the US. FATCA also requires that financial institutions overseas report detail about US clients to the IRS in America. FATCA was originally conceived as a means of making it tough for US taxpayers to hide financial assets that are kept in offshore banks or in the accounts of foreign institutions. FATCA is controversial among US expats and US citizens with assets overseas for a number of reasons, although these people must still comply with the requirements of the act.

There are three main provisions to FATCA. The first is that a foreign financial institution, such as a bank or a savings scheme, must agree to identify to the IRS any US account holders. The disclosure must include the names of the account holders, and the transactions that take place within the accounts.

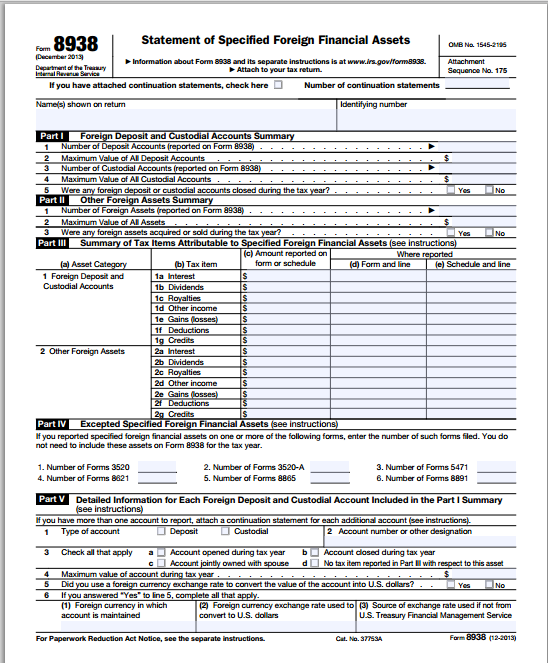

The second is that any US citizen must report their foreign accounts or assets held overseas. IRS FATCA rules state that the reporting must be on the IRS Form 8938, which is entitled Statement of Specified Foreign Financial Assets. This form is generally filed along with the tax return considering that the accounts are worth in excess of US$50,000.

The third consideration is that FATCA cuts the risk of foreign investors avoiding taxes on US dividends.

History and Background of FATCA

By conservative estimates, the US Treasury loses up to $100 billion every year to citizens’ non-compliance with tax due to holding money in offshore banks. For certain, the US Treasury wants to avoid these losses and as such introduced the Foreign Account Tax Compliance Act of 2009 in Congress. The bill was signed into law in 2010. Financial institutions overseas must report to the IRS information on assets held in their institution by US taxpayers. Under tax law in the US, US citizens are required to pay tax on foreign income even when they live abroad. Because of this factor, Americans living abroad are particularly affected by this new federal law.

FATCA: What You Need to Do

Individuals need to report information related to foreign financial accounts and any assets that are held offshore on the IRS Form 8938. This should be attached to the income tax return. The basic concept is – if you have financial assets that are held in foreign accounts, you need to report this information to the IRS. The FATCA requirement goes alongside the need to report foreign assets on the FinCEN Form 114, which is the Report of Foreign Bank and Financial Accounts (FBAR). You need to carry out this reporting if you hold assets overseas that are worth more than the threshold – $50,000. This threshold differs for certain people, including those that file a joint annual income tax return with a spouse, and some taxpayers that live in an overseas country.

Foreign financial institutions must register with the IRS and use a Global Intermediary Identification Number (GIIN) to report certain data to the IRS about US citizen accounts. If you set up an account as a US citizen with a financial institution which is based overseas the institution may ask you questions regarding your citizenship.

FATCA Penalties

FATCA compliance is important. There are serious penalties involved for people that do not follow the reporting requirements for this law. If you need to report overseas assets and you do not do it, you could be liable for a penalty of $10,000 for failure to file, plus an extra penalty of up to $50,000 if you continue to fail to file after you have received a notification from the IRS. The due date for FBAR filing is June 30 and it is filed electronically, while the FATCA form is sent with the annual income tax return.